My husband, Chris unpacks how to get started with your investment accounts. It can be a lot to take in, so sit down grab a pen and get excited for your future!

Me. You. The Market.

The stock market appears overwhelming at first. There are SO many decisions you have to make, right? Should I buy stocks or bonds? Do I have to pick EVERY SINGLE company I want to invest in? How do I pick a brokerage to buy stocks through? How much money do I need? What are swaps, options, market orders, limit orders, or shorts?

Let me diminish some of your concerns. The universe of the stock market is big, but you do not need to know it all. You don’t even need to know most of it. Can you balance your check book? Yes? Then, you can trade stocks. It’s as simple as that.

I’m going to share with you what I’ve learned and how I trade. It’s basic stuff, long-term investing. Five years ago, I knew NOTHING about the stock market, except that people made money on it. Then, I got a job at a hedge fund—not a shady "hedge fund" but a small, private company with a strategy that invested their OWN money (not other people’s money)—and the trader and owner taught me the simple stuff. That is what I am going to share with you. I have to clarify that I am not a professional, and I am not certified to give you any financial advice.

Start Here.

You need to open an account at a brokerage. For that, you need some cash and a social security number. Have you ever opened a bank account? Ever in your life? You have? You can open an account at a brokerage. It’s just as easy.

Afraid to put your money into a brokerage account? "What if they take my money and go bankrupt?" You do have a bank account, right? That bank account is insured by the FDIC for up to $100k in the event the bank goes bust. Your investments (at any of the brokerages I suggest) are insured by the SIPC for up to $500k in investments—$250k of which can be cash.

How much money do you need to start? It varies by the brokerage, but I would recommend starting with $2000 - $3000. However, TDA lets you open an IRA with nothing. Now… which of the 100 brokerages should you use? Well, I’m going to make a few brokerage recommendations based on (1) personal experience and (2) commission-free ETF trades. (You’ll see the term "ETF" a bit below—put it on the back-burner, we’ll talk about it later.)

(1) Vanguard. My wife's IRA is here. If I were to recommend one brokerage, this would be it. If you call them, I think you can start an account with as little as $1000, else it’s $3000. Good points: lowest expense ratios for ETF's, best policy for commission-free etf trades. Bad points: not the most extensive customer support. I once waited on the phone 40 minutes, and there are no offices you can "walk in to".

(2) Fidelity. Most of my money is at Fidelity, simply because it’s where my 401k was originally and it was easiest to roll it into an IRA there. You need $2500 to open an account. Good points: lots of customer support: chat support, weekend support, swift replies. And, of course, they have offices everywhere. Fairly easy-to-use website. Bad points: you have to own an ETF for 30 days before selling it commission-free and ever-so-slightly higher expense ratios (compared to Vanguard).

(3) TD Ameritrade. The hedge fund I worked for had a lot of money here. No minimum to open an account. Good points: most commission-free ETF’s available (basically Fidelity and Vanguard combined), lots of support. Bad points: higher trading costs if you go outside of commission-free trades, and (like Fidelity) you have to own an ETF for 30 days before selling it commission-free.

You'll need to pick an account type. It’s a good idea to have a retirement account: they grow tax-free. If you are under 50 years-old, you can contribute up to $5,500/year to an IRA. I recommend opening a "Roth IRA" if you make less than $115k single / $180k married-joint each year and you don't have a retirement account through your work (if you do, read this simple IRS article). A "traditional IRA" is taxed when you withdraw, a "Roth IRA" is taxed now and tax-free when you withdraw. However, a Roth has other benefits, and one of them is you can withdraw ANY CASH CONTRIBUTION without penalties. A traditional IRA has penalties if you withdraw before retiring. That means, with a Roth, if you put in $5000 in cash and it grows to $6000, you can withdraw the $5000 at any time (the other $1000 has to stay in the IRA until retirement). Here's an IRA Comparison Chart, if you'd like to know more.

Our family has both: my wife's is a traditional IRA, mine is a Roth. Honestly, the tax benefits of a traditional IRA are better if you make less than $100k joint / $70k single: it makes more sense to pay the taxes when you retire because right now, when you're earning more, you want all the tax breaks you can get. However, there is a marginal amount of security knowing that if you had to, you could withdraw your Roth cash contributions without penalty.

When you set up your brokerage account, I would advise you to link your IRA to your bank account so you can deposit or withdraw funds whenever you want. When I started investing, I would bill-pay (send a check) to the brokerage, but that took too long when I wanted to buy while prices were down. And, I've never had any issues transferring money between my credit union checking account an my brokerage.

Stocks. Bonds. Buy. Sell.

I'm going to focus on things that make sense: stocks and bonds. Stocks are just ownership in a company. Bonds are when you loan a company (or government) money, and they pay you back with interest. We are going to look at Domestic (US) stocks and bonds and Foreign (outside the US) stocks and bonds.

We are going to focus on LONG-TERM investing (5, 10, 20, or 40 years) and exclusively buy "ETF's" (Exchange-Traded Funds)—more specifically, "Index Funds". Have you heard of the S&P500? Probably. It's an "index" of the 500 largest companies in the US. You can buy 1 share of an ETF that holds all 500 companies. That means with about $200 for 1 share, you can get immediate diversification: 4% in Apple, 2% in Exxon, 2% in Microsoft, 2% in Johnson & Johnson, etc.

Why are we buying Index Funds? For a few reasons:

(1) They have *low* costs (called "expense ratios"). Basically, there is some cost in running a Fund. The good thing about Index Funds is they are just replicating what an Index is doing, so there is almost no cost associated with them (typically, less than 0.10%/year). Other funds or "advisor services" will cost you more (anywhere between 1% and 3%). That may not sound like much, but over the span of 20-40 years, it adds up to a BIG difference!

(2) Funds give you INSTANT diversity. No need to pick from thousands of companies or bonds. You get diversity immediately.

(3) They trade JUST like stock: so you can buy and sell them whenever you want. Mutual Funds typically "settle" at the end of the day, so you get a mutual fund at its closing price. ETF's also have "tickers" just like stock. If you go onto Yahoo Finance and enter the symbol "AAPL", you'll get Apple. If you enter "IVV" or "VOO", you'll get an S&P500 Index Fund just like you would any other stock.

(4) Many brokerages (all the ones I suggested) have a decent portfolio of ETF's that trade commission-free. That means the usual $8 or $10 "trading fee" does not apply... even if you buy only 1 share, it is FREE to trade! :-D

(5) Historically, ETF's have as-good or better returns than anything else (mutual funds, hedge funds, etc.)

(6) ETF's pay dividends! When a company has profits (every quarter or every year), one of the things they CAN do (if they choose) is give money back to the investors. This is called a "dividend". Bonds have "dividends", too, which are essentially the interest you earn on loaning companies money. The difference between stock and bond dividends is that companies HAVE to pay back bond obligations, even if times are tough—they don't have to pay stock dividends.

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings."

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings."

Let's Talk About Diversity.

You'll hear a lot of talk about how you need to "diversify" your portfolio. Yes. You do. Period. If you put all of your money into stocks, and stocks start to drop when you need the money (like they did in 2002 or 2009), you're in bad shape. Bonds, however, have a pretty steady (low) return. This graph compares what is happening between the S&P500 and a bond fund over the last 10 years. You'll notice the bond is pretty flat. The S&P500 has a great return NOW, but if you needed to sell in 2009 you would be in bad shape. Your bonds, however, would have been okay.

How much should you put in stocks vs bonds, foreign vs domestic? A common rubric is to subtract your age from 100. That's how much money you should have in stocks. I'm 30. 100 - 30 = 70. So, 70% of my IRA "should" be in stocks. In reality, it's closer to 85% because I'm young—if the stock market tanks, I can probably ride it out because I'll still be working—it's worth taking more risk for more return. When I'm 60 and close to retirement, however, that will change.

How do you choose how to split up your money? It comes down to one question: do you like risk? If you buy a stock fund and it drops 5% the next day, are you going to freak out and be tempted to sell and get your money back (even if it is at a loss)? Or are you going to buy more? If you like risk (or are pretty young), put more in stocks, if you don't like risk put more in bonds. You might go 50/50. You might go 80/20. You might do the "100 minus your age thing". You might put 25% into domestic stock, 25% into foreign stock, 25% into domestic bonds, 25% into foreign bonds. Personally, about 60% of our IRA's money is in domestic stock, 25% is in foreign stock, and 15% is in bonds.

I Don't Want Your Purchasing Advice! Can I Research ETF's On My Own?

ABSO-FREAKING-LUTELY. I am going to recommend some ETF's to purchase below. But, you might be into researching every free ETF that Vanguard, Fidelity, or TDA offer. Here are two good resources (there are others): yahoo finance and etfdb.

I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv).

I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv).

On the LEFT is a Navigation bar all about "IVV". It's "Profile" at the bottom will show you the expense ratio (0.07%), "Holdings" will show you it's top 10 stocks (Apple, Exxon, Microsoft, etc.) and how it's broken up by sector (technology, healthcare, finance, etc.). The *only* thing I really use Yahoo Finance for is determining my price. If you click on "Interactive" under "CHARTS", you'll see a graph of the ETF price. Change the range to 1 year ("1Y") to see what the ETF has done for the last year just to get an idea for growth. For more on how to pick your price, see "Actually Buying Crap" below.

ETFDB (ETF DataBase) is great to show you graphs about where the money goes and (for bonds) what they pay you annually. Let's stick with IVV: http://etfdb.com/etf/IVV/.

If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

WTF Should I Buy?

Domestic Stocks. Consider the S&P500 (500 largest US companies), S&P400 (400 medium-sized companies), S&P600 (600 smallest companies), or Total US Stock Market (all 1500 large, medium, and small companies). My favorite? S&P400—it has a good mix of stability and return. Of course, it's more risky than the S&P500 but it has a good track record. Some tickers for commission-free ETF's (and its brokerage) are:

(1) "IVV" (Fidelity) or "VOO" (Vanguard) for the S&P500.

(2) "IJH" (Fidelity) or "VO" (Vanguard) are S&P400 tickers.

(3) "ITOT" (Fidelity) and "VTI" (Vanguard) are the Total US Stock Market.

Foreign Stocks. Basically, you have "developed" and "emerging" countries. Developed countries are places like Europe, Japan, Canada, South Korea, Australia, etc. "Emerging" are other countries: China, India, Russia, Brazil, etc. Emerging are usually higher risk, higher return / loss.

(1) "IXUS" (Fidelity) or "VXUS" (Vanguard) for all non-us (emerging and developed).

(2) "IEFA" (Fidelity) or "VEA" (Vanguard) for "developed" countries.

(3) "IEMG" (Fidelity) or "VWO" (Vanguard) for "emerging" countries.

Domestic Bonds. There are "government" or "corporate" bonds. You'll also hear about "junk" bonds. "Junk bonds" are bonds with low credit ratings that are not the "safest" investments but they typically pay higher dividends. There are lots of bond ETF options (not commission-free) that pay better yields and are fairly low-risk, but I'm sticking with these for simplicity sake.

(1) "AGG" (Fidelity) or "BND" (Vanguard) are "mixed" bond funds - highly rated (lower risk) corporate bonds and government bonds. They pay between 2.3% and 2.8% on your money.

(2) "LQD" (Fidelity) or "VCIT" (Vanguard) are high-grade "corporate" bond funds that pay between 3.0% and 3.25%.

Foreign Bonds. Honestly, this is where I am weakest, and it's where there are the fewest options when it comes to commission-free ETF's. However, there are a few options out there...

(1) "IGOV" (Fidelity) is an international government bond fund primarily focussed on countries with AAA or AA credit rating. It's dividend is paltry, though, at just over 1%.

(2) "BNDX" (Vanguard) is similar, *most* of the bonds are AAA or AA governments, but there are some corporate and slightly lower-grade bonds mixed in. The returns are also slightly better at 1.5%

(3) "EMB" (Fidelity) or "VWOB" (Vanguard) are emerging markets government bonds. They return about 4.5%, but are a little riskier given the fact that the governments are in emerging countries.

You're probably thinking, "Wait, some of those bond funds BARELY pay a dividend higher than what the S&P500 pays!" ("IVV" pays about 2% in dividends) "Why in the heck would I put money into bonds EVER?!!" Again, you need to diversify. Sure, things are going great now, but what happens when (not "if", WHEN) the stock market dives again like it did in 2009? You'll be glad your bonds are not diving like your stocks are.

Actually Buying Crap. Limit Orders. Market Orders. Choosing Your Price.

If you haven't already, sit down and figure out where you want to put your money. Say you have $3000. What percent do you want to go to stocks? Bonds? Foreign? Domestic? For simplicity, let's say you put 2/3 into stocks, 1/3 into bonds: $2000 in stocks and $1000 in bonds. From that, $1500 will be domestic stock, $500 will be foreign stock, $500 will be domestic bonds, $500 will be foreign bonds. And, for simplicity, let's just put all $1500 into "IVV" (or "VOO") for the S&P500 and $500 into "IXUS" (or "VXUS") for "Total Non-US Stock Market". We'll put all $500 of our bond money into "AGG" (or "BND") for domestic and $500 into "IGOV" (or "BNDX") for foreign bonds.

Imagine walking into a grocery store and saying "I want to buy a pound of meat, I don't care the price." That's kind of crazy. You'll *probably* pay much more than you should or more than you want to. That's what a "market order" is. That is when you walk on to the New York Stock Exchange and say, "I want to buy IVV right now! I don't care the price!" We're not going to do that. We're going to pick our price using a "limit order".

Pop over to Yahoo Finance and look up ticker "IVV" (or "VOO" for Vanguard). Or, click one of these - http://finance.yahoo.com/q?s=ivv and http://finance.yahoo.com/q?s=voo. You will see a a price for what the fund is currently trading at (somewhere in the neighborhood of $200). Now, click on the blue chart. It will take you to a larger, interactive chart. Change the time period from "1d" (one day) to "1m" or "3m". Why? Because you don't care about what the fund is doing every second of one day, we want to get a "sense" for what we want to buy at.

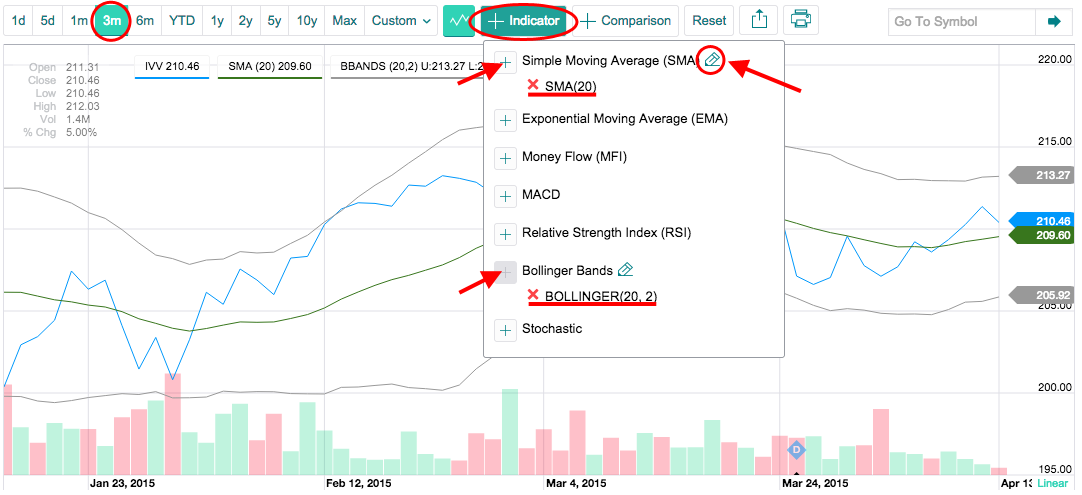

We're going to turn on two features: a "Simple Moving Average" (or "SMA") and "Bollinger Bands". A "Simple Moving Average" shows you what the "average" price is for a time period. Set it to 20 days. Why 20 days? 20 working days is one month—a decent metric for a fund's price. On the "Indicator" button of the graph, select the plus sign next to "Simple Moving Average"—it will probably default to 50. Click the little "pencil" icon to edit, and change the time period to 20. Now, click the "Indicator" button again and select "Bollinger Bands" at the bottom—it should default to "(20, 2)", which is what we want. Bollinger Bands are a "standard deviation" – put simply, they're a way to say (with no certainty, of course) that the price of the fund stays "roughly" or "in general" between those lines.

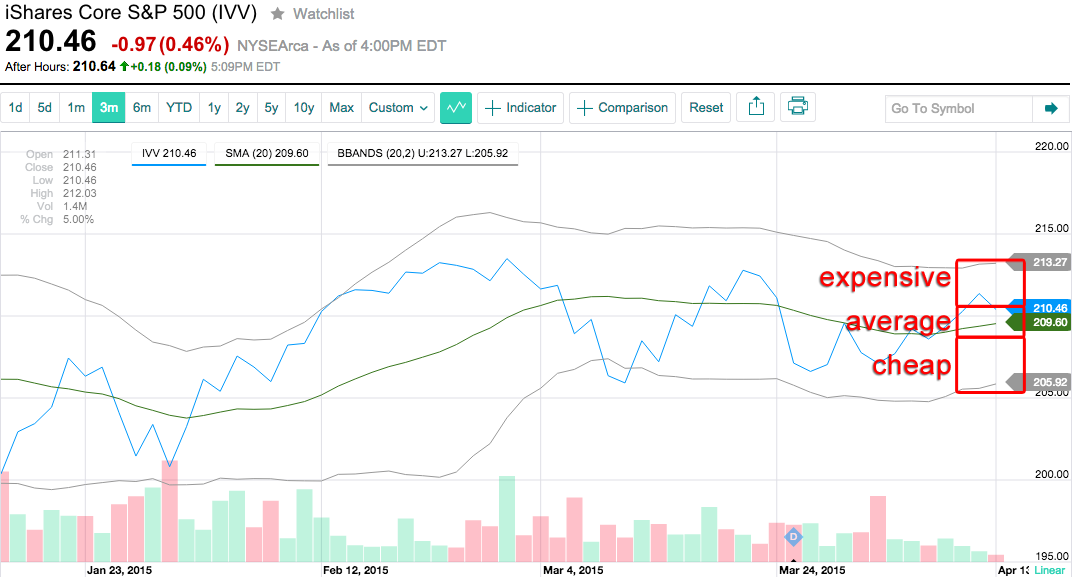

Now you know what price to buy at. Anything ON the SMA is an "average" price. Anything ABOVE the SMA is "expensive" and anything below it is "cheap". Anything above the UPPER bollinger band is REALLY expensive. Anything below the LOWER bollinger band is REALLY cheap. Now, you have to decide what price you WANT to pay for something. Do you want to get it on sale? I do. But, keep in mind that there is NO "guarantee" that the price will hit the price you want to pay. And, the price could keep dropping, even if it's below the lower bollinger. Try not to worry about that. Remember, you are interested in LONG term: where the price will be in 10, 20, or 40 years. So, getting it for $201 instead of $200 is not a big deal when (in 20 years) the price is $500 (hypothetically, of course).

What do I do? I pick a price usually between the SMA and the lower bollinger band. Then, I let it sit for two weeks or a month and see if the order fills. Of course, I NEVER pay more that the current "ask" price. If the price of IVV was $211.54, there's no way I would try to buy it at $215! That wouldn't make sense.

Does my price always fill? No—and when it doesn't I have to re-evaluate the price I want to pay based on how the price has moved in the previous weeks. However, about 70% of the time, it does hit my price. Remember, the closer to the SMA you are, the more likely it will fill.

Now you do the same thing for the other funds (IXUS, AGG, etc.) that you did for IVV. Figure out what price you want to pay for each fund. Write it all down. Figure out how many shares you can get for that price. For example, with IVV, we planned to invest $1500. Let's say I figure $208 is a good price for IVV. $1500 / $208 = 7.212. You can only buy 7 shares, you can't buy partial shares.

Now that we have our shopping list of what we want to buy, we are going to go to the "trading" area of our brokerage and make a "limit order" to BUY 7 shares of "IVV" at $208. And we're going to set it as "Good 'Til Canceled" (or "GTC"). Vanguard will keep an order on the books for 60 days if you don't touch it. Fidelity will leave it open for several months.

One final note: don't buy-and-sell too fast! Once you buy a fund, there is a period of several days where you don't "have" it yet called a "settlement period". I only bring it up because during this period, you must not sell it. A conservative way to remember this is that, if you buy a stock on Tuesday, you don't try to sell it until the next Tuesday. Will that matter for you? Probably not because you're not buying-and-selling often, but you should know. Same thing goes for selling—you don't have the money to buy something until after the settlement period is over.

Whew! you made it! Have questions? I know I do! Write them in the comments and we'll try to answer them soon!

My husband, Chris unpacks how to get started with your investment accounts. It can be a lot to take in, so sit down grab a pen and get excited for your future!

Me. You. The Market.

The stock market appears overwhelming at first. There are SO many decisions you have to make, right? Should I buy stocks or bonds? Do I have to pick EVERY SINGLE company I want to invest in? How do I pick a brokerage to buy stocks through? How much money do I need? What are swaps, options, market orders, limit orders, or shorts?

Let me diminish some of your concerns. The universe of the stock market is big, but you do not need to know it all. You don’t even need to know most of it. Can you balance your check book? Yes? Then, you can trade stocks. It’s as simple as that.

I’m going to share with you what I’ve learned and how I trade. It’s basic stuff, long-term investing. Five years ago, I knew NOTHING about the stock market, except that people made money on it. Then, I got a job at a hedge fund—not a shady "hedge fund" but a small, private company with a strategy that invested their OWN money (not other people’s money)—and the trader and owner taught me the simple stuff. That is what I am going to share with you. I have to clarify that I am not a professional, and I am not certified to give you any financial advice.

Start Here.

You need to open an account at a brokerage. For that, you need some cash and a social security number. Have you ever opened a bank account? Ever in your life? You have? You can open an account at a brokerage. It’s just as easy.

Afraid to put your money into a brokerage account? "What if they take my money and go bankrupt?" You do have a bank account, right? That bank account is insured by the FDIC for up to $100k in the event the bank goes bust. Your investments (at any of the brokerages I suggest) are insured by the SIPC for up to $500k in investments—$250k of which can be cash.

How much money do you need to start? It varies by the brokerage, but I would recommend starting with $2000 - $3000. However, TDA lets you open an IRA with nothing. Now… which of the 100 brokerages should you use? Well, I’m going to make a few brokerage recommendations based on (1) personal experience and (2) commission-free ETF trades. (You’ll see the term "ETF" a bit below—put it on the back-burner, we’ll talk about it later.)

(1) Vanguard. My wife's IRA is here. If I were to recommend one brokerage, this would be it. If you call them, I think you can start an account with as little as $1000, else it’s $3000. Good points: lowest expense ratios for ETF's, best policy for commission-free etf trades. Bad points: not the most extensive customer support. I once waited on the phone 40 minutes, and there are no offices you can "walk in to".

(2) Fidelity. Most of my money is at Fidelity, simply because it’s where my 401k was originally and it was easiest to roll it into an IRA there. You need $2500 to open an account. Good points: lots of customer support: chat support, weekend support, swift replies. And, of course, they have offices everywhere. Fairly easy-to-use website. Bad points: you have to own an ETF for 30 days before selling it commission-free and ever-so-slightly higher expense ratios (compared to Vanguard).

(3) TD Ameritrade. The hedge fund I worked for had a lot of money here. No minimum to open an account. Good points: most commission-free ETF’s available (basically Fidelity and Vanguard combined), lots of support. Bad points: higher trading costs if you go outside of commission-free trades, and (like Fidelity) you have to own an ETF for 30 days before selling it commission-free.

You'll need to pick an account type. It’s a good idea to have a retirement account: they grow tax-free. If you are under 50 years-old, you can contribute up to $5,500/year to an IRA. I recommend opening a "Roth IRA" if you make less than $115k single / $180k married-joint each year and you don't have a retirement account through your work (if you do, read this simple IRS article). A "traditional IRA" is taxed when you withdraw, a "Roth IRA" is taxed now and tax-free when you withdraw. However, a Roth has other benefits, and one of them is you can withdraw ANY CASH CONTRIBUTION without penalties. A traditional IRA has penalties if you withdraw before retiring. That means, with a Roth, if you put in $5000 in cash and it grows to $6000, you can withdraw the $5000 at any time (the other $1000 has to stay in the IRA until retirement). Here's an IRA Comparison Chart, if you'd like to know more.

Our family has both: my wife's is a traditional IRA, mine is a Roth. Honestly, the tax benefits of a traditional IRA are better if you make less than $100k joint / $70k single: it makes more sense to pay the taxes when you retire because right now, when you're earning more, you want all the tax breaks you can get. However, there is a marginal amount of security knowing that if you had to, you could withdraw your Roth cash contributions without penalty.

When you set up your brokerage account, I would advise you to link your IRA to your bank account so you can deposit or withdraw funds whenever you want. When I started investing, I would bill-pay (send a check) to the brokerage, but that took too long when I wanted to buy while prices were down. And, I've never had any issues transferring money between my credit union checking account an my brokerage.

Stocks. Bonds. Buy. Sell.

I'm going to focus on things that make sense: stocks and bonds. Stocks are just ownership in a company. Bonds are when you loan a company (or government) money, and they pay you back with interest. We are going to look at Domestic (US) stocks and bonds and Foreign (outside the US) stocks and bonds.

We are going to focus on LONG-TERM investing (5, 10, 20, or 40 years) and exclusively buy "ETF's" (Exchange-Traded Funds)—more specifically, "Index Funds". Have you heard of the S&P500? Probably. It's an "index" of the 500 largest companies in the US. You can buy 1 share of an ETF that holds all 500 companies. That means with about $200 for 1 share, you can get immediate diversification: 4% in Apple, 2% in Exxon, 2% in Microsoft, 2% in Johnson & Johnson, etc.

Why are we buying Index Funds? For a few reasons:

(1) They have *low* costs (called "expense ratios"). Basically, there is some cost in running a Fund. The good thing about Index Funds is they are just replicating what an Index is doing, so there is almost no cost associated with them (typically, less than 0.10%/year). Other funds or "advisor services" will cost you more (anywhere between 1% and 3%). That may not sound like much, but over the span of 20-40 years, it adds up to a BIG difference!

(2) Funds give you INSTANT diversity. No need to pick from thousands of companies or bonds. You get diversity immediately.

(3) They trade JUST like stock: so you can buy and sell them whenever you want. Mutual Funds typically "settle" at the end of the day, so you get a mutual fund at its closing price. ETF's also have "tickers" just like stock. If you go onto Yahoo Finance and enter the symbol "AAPL", you'll get Apple. If you enter "IVV" or "VOO", you'll get an S&P500 Index Fund just like you would any other stock.

(4) Many brokerages (all the ones I suggested) have a decent portfolio of ETF's that trade commission-free. That means the usual $8 or $10 "trading fee" does not apply... even if you buy only 1 share, it is FREE to trade! :-D

(5) Historically, ETF's have as-good or better returns than anything else (mutual funds, hedge funds, etc.)

(6) ETF's pay dividends! When a company has profits (every quarter or every year), one of the things they CAN do (if they choose) is give money back to the investors. This is called a "dividend". Bonds have "dividends", too, which are essentially the interest you earn on loaning companies money. The difference between stock and bond dividends is that companies HAVE to pay back bond obligations, even if times are tough—they don't have to pay stock dividends.

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings."

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings."

Let's Talk About Diversity.

You'll hear a lot of talk about how you need to "diversify" your portfolio. Yes. You do. Period. If you put all of your money into stocks, and stocks start to drop when you need the money (like they did in 2002 or 2009), you're in bad shape. Bonds, however, have a pretty steady (low) return. This graph compares what is happening between the S&P500 and a bond fund over the last 10 years. You'll notice the bond is pretty flat. The S&P500 has a great return NOW, but if you needed to sell in 2009 you would be in bad shape. Your bonds, however, would have been okay.

How much should you put in stocks vs bonds, foreign vs domestic? A common rubric is to subtract your age from 100. That's how much money you should have in stocks. I'm 30. 100 - 30 = 70. So, 70% of my IRA "should" be in stocks. In reality, it's closer to 85% because I'm young—if the stock market tanks, I can probably ride it out because I'll still be working—it's worth taking more risk for more return. When I'm 60 and close to retirement, however, that will change.

How do you choose how to split up your money? It comes down to one question: do you like risk? If you buy a stock fund and it drops 5% the next day, are you going to freak out and be tempted to sell and get your money back (even if it is at a loss)? Or are you going to buy more? If you like risk (or are pretty young), put more in stocks, if you don't like risk put more in bonds. You might go 50/50. You might go 80/20. You might do the "100 minus your age thing". You might put 25% into domestic stock, 25% into foreign stock, 25% into domestic bonds, 25% into foreign bonds. Personally, about 60% of our IRA's money is in domestic stock, 25% is in foreign stock, and 15% is in bonds.

I Don't Want Your Purchasing Advice! Can I Research ETF's On My Own?

ABSO-FREAKING-LUTELY. I am going to recommend some ETF's to purchase below. But, you might be into researching every free ETF that Vanguard, Fidelity, or TDA offer. Here are two good resources (there are others): yahoo finance and etfdb.

I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv).

I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv).

On the LEFT is a Navigation bar all about "IVV". It's "Profile" at the bottom will show you the expense ratio (0.07%), "Holdings" will show you it's top 10 stocks (Apple, Exxon, Microsoft, etc.) and how it's broken up by sector (technology, healthcare, finance, etc.). The *only* thing I really use Yahoo Finance for is determining my price. If you click on "Interactive" under "CHARTS", you'll see a graph of the ETF price. Change the range to 1 year ("1Y") to see what the ETF has done for the last year just to get an idea for growth. For more on how to pick your price, see "Actually Buying Crap" below.

ETFDB (ETF DataBase) is great to show you graphs about where the money goes and (for bonds) what they pay you annually. Let's stick with IVV: http://etfdb.com/etf/IVV/.

If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

WTF Should I Buy?

Domestic Stocks. Consider the S&P500 (500 largest US companies), S&P400 (400 medium-sized companies), S&P600 (600 smallest companies), or Total US Stock Market (all 1500 large, medium, and small companies). My favorite? S&P400—it has a good mix of stability and return. Of course, it's more risky than the S&P500 but it has a good track record. Some tickers for commission-free ETF's (and its brokerage) are:

(1) "IVV" (Fidelity) or "VOO" (Vanguard) for the S&P500.

(2) "IJH" (Fidelity) or "VO" (Vanguard) are S&P400 tickers.

(3) "ITOT" (Fidelity) and "VTI" (Vanguard) are the Total US Stock Market.

Foreign Stocks. Basically, you have "developed" and "emerging" countries. Developed countries are places like Europe, Japan, Canada, South Korea, Australia, etc. "Emerging" are other countries: China, India, Russia, Brazil, etc. Emerging are usually higher risk, higher return / loss.

(1) "IXUS" (Fidelity) or "VXUS" (Vanguard) for all non-us (emerging and developed).

(2) "IEFA" (Fidelity) or "VEA" (Vanguard) for "developed" countries.

(3) "IEMG" (Fidelity) or "VWO" (Vanguard) for "emerging" countries.

Domestic Bonds. There are "government" or "corporate" bonds. You'll also hear about "junk" bonds. "Junk bonds" are bonds with low credit ratings that are not the "safest" investments but they typically pay higher dividends. There are lots of bond ETF options (not commission-free) that pay better yields and are fairly low-risk, but I'm sticking with these for simplicity sake.

(1) "AGG" (Fidelity) or "BND" (Vanguard) are "mixed" bond funds - highly rated (lower risk) corporate bonds and government bonds. They pay between 2.3% and 2.8% on your money.

(2) "LQD" (Fidelity) or "VCIT" (Vanguard) are high-grade "corporate" bond funds that pay between 3.0% and 3.25%.

Foreign Bonds. Honestly, this is where I am weakest, and it's where there are the fewest options when it comes to commission-free ETF's. However, there are a few options out there...

(1) "IGOV" (Fidelity) is an international government bond fund primarily focussed on countries with AAA or AA credit rating. It's dividend is paltry, though, at just over 1%.

(2) "BNDX" (Vanguard) is similar, *most* of the bonds are AAA or AA governments, but there are some corporate and slightly lower-grade bonds mixed in. The returns are also slightly better at 1.5%

(3) "EMB" (Fidelity) or "VWOB" (Vanguard) are emerging markets government bonds. They return about 4.5%, but are a little riskier given the fact that the governments are in emerging countries.

You're probably thinking, "Wait, some of those bond funds BARELY pay a dividend higher than what the S&P500 pays!" ("IVV" pays about 2% in dividends) "Why in the heck would I put money into bonds EVER?!!" Again, you need to diversify. Sure, things are going great now, but what happens when (not "if", WHEN) the stock market dives again like it did in 2009? You'll be glad your bonds are not diving like your stocks are.

Actually Buying Crap. Limit Orders. Market Orders. Choosing Your Price.

If you haven't already, sit down and figure out where you want to put your money. Say you have $3000. What percent do you want to go to stocks? Bonds? Foreign? Domestic? For simplicity, let's say you put 2/3 into stocks, 1/3 into bonds: $2000 in stocks and $1000 in bonds. From that, $1500 will be domestic stock, $500 will be foreign stock, $500 will be domestic bonds, $500 will be foreign bonds. And, for simplicity, let's just put all $1500 into "IVV" (or "VOO") for the S&P500 and $500 into "IXUS" (or "VXUS") for "Total Non-US Stock Market". We'll put all $500 of our bond money into "AGG" (or "BND") for domestic and $500 into "IGOV" (or "BNDX") for foreign bonds.

Imagine walking into a grocery store and saying "I want to buy a pound of meat, I don't care the price." That's kind of crazy. You'll *probably* pay much more than you should or more than you want to. That's what a "market order" is. That is when you walk on to the New York Stock Exchange and say, "I want to buy IVV right now! I don't care the price!" We're not going to do that. We're going to pick our price using a "limit order".

Pop over to Yahoo Finance and look up ticker "IVV" (or "VOO" for Vanguard). Or, click one of these - http://finance.yahoo.com/q?s=ivv and http://finance.yahoo.com/q?s=voo. You will see a a price for what the fund is currently trading at (somewhere in the neighborhood of $200). Now, click on the blue chart. It will take you to a larger, interactive chart. Change the time period from "1d" (one day) to "1m" or "3m". Why? Because you don't care about what the fund is doing every second of one day, we want to get a "sense" for what we want to buy at.

We're going to turn on two features: a "Simple Moving Average" (or "SMA") and "Bollinger Bands". A "Simple Moving Average" shows you what the "average" price is for a time period. Set it to 20 days. Why 20 days? 20 working days is one month—a decent metric for a fund's price. On the "Indicator" button of the graph, select the plus sign next to "Simple Moving Average"—it will probably default to 50. Click the little "pencil" icon to edit, and change the time period to 20. Now, click the "Indicator" button again and select "Bollinger Bands" at the bottom—it should default to "(20, 2)", which is what we want. Bollinger Bands are a "standard deviation" – put simply, they're a way to say (with no certainty, of course) that the price of the fund stays "roughly" or "in general" between those lines.

Now you know what price to buy at. Anything ON the SMA is an "average" price. Anything ABOVE the SMA is "expensive" and anything below it is "cheap". Anything above the UPPER bollinger band is REALLY expensive. Anything below the LOWER bollinger band is REALLY cheap. Now, you have to decide what price you WANT to pay for something. Do you want to get it on sale? I do. But, keep in mind that there is NO "guarantee" that the price will hit the price you want to pay. And, the price could keep dropping, even if it's below the lower bollinger. Try not to worry about that. Remember, you are interested in LONG term: where the price will be in 10, 20, or 40 years. So, getting it for $201 instead of $200 is not a big deal when (in 20 years) the price is $500 (hypothetically, of course).

What do I do? I pick a price usually between the SMA and the lower bollinger band. Then, I let it sit for two weeks or a month and see if the order fills. Of course, I NEVER pay more that the current "ask" price. If the price of IVV was $211.54, there's no way I would try to buy it at $215! That wouldn't make sense.

Does my price always fill? No—and when it doesn't I have to re-evaluate the price I want to pay based on how the price has moved in the previous weeks. However, about 70% of the time, it does hit my price. Remember, the closer to the SMA you are, the more likely it will fill.

Now you do the same thing for the other funds (IXUS, AGG, etc.) that you did for IVV. Figure out what price you want to pay for each fund. Write it all down. Figure out how many shares you can get for that price. For example, with IVV, we planned to invest $1500. Let's say I figure $208 is a good price for IVV. $1500 / $208 = 7.212. You can only buy 7 shares, you can't buy partial shares.

Now that we have our shopping list of what we want to buy, we are going to go to the "trading" area of our brokerage and make a "limit order" to BUY 7 shares of "IVV" at $208. And we're going to set it as "Good 'Til Canceled" (or "GTC"). Vanguard will keep an order on the books for 60 days if you don't touch it. Fidelity will leave it open for several months.

One final note: don't buy-and-sell too fast! Once you buy a fund, there is a period of several days where you don't "have" it yet called a "settlement period". I only bring it up because during this period, you must not sell it. A conservative way to remember this is that, if you buy a stock on Tuesday, you don't try to sell it until the next Tuesday. Will that matter for you? Probably not because you're not buying-and-selling often, but you should know. Same thing goes for selling—you don't have the money to buy something until after the settlement period is over.

Whew! you made it! Have questions? I know I do! Write them in the comments and we'll try to answer them soon!

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings."

Dividend side note: when you set up your account at a brokerage, find out how to get your dividends "deposited" and not "reinvested." You want dividends as cash because YOU want to decided when to reinvest your money and to what companies—you don't want the fund to decide that for you. This is usually in "dividends and capital gains" settings or in your "account settings." I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv).

I am going to give you an example using the ticker "IVV" (similar to "VOO")—an ETF modeled after the S&P500. If you go to finance.yahoo.com and (in the "Quote Lookup" search box) enter the ticker "IVV" (or just click this link: http://finance.yahoo.com/q?s=ivv). If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

If you scroll down the page to "Top Ten Holdings", you'll see some of the same data as Yahoo Finance. However, if you scroll down, ETFDB also shows you some great pie charts of where the money goes. For IVV, it's essentially all Domestic stocks and mostly in "Giant" and "Large" companies. You'll also see the "Dividend" of about 1.9%. That means that, annually, the ETF *also* pays you about 2% cash. Check out something more international like "VXUS" - http://etfdb.com/etf/VXUS/ - and look under "holdings". You'll see a pretty cool pie chart of how the fund is allocated per country.

No comments:

Post a Comment